How it works

Empirico wants to make easy and accessible the configuration, execution, testing, and comparison of systematic investment strategies and help you turn them into real trades.

Unlike alternative tools, it is powerful enough to run the strategy across a universe of investable instruments, and to generate a portfolio which is then automatically rebalanced for the timespan of the user-defined simulation.

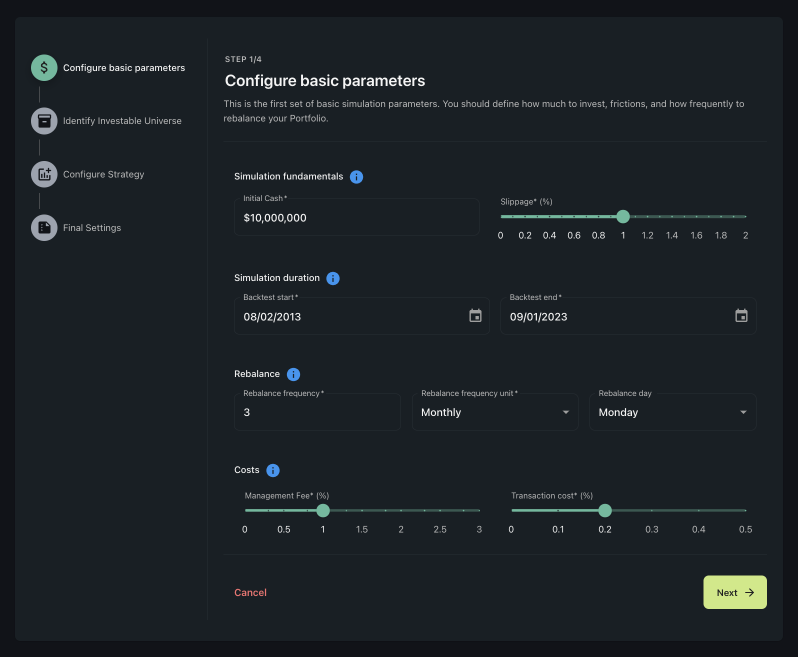

Configure strategy parameters and investable universe

When you create a new simulation, Empirico guides you through the definition of relevant parameters that define the investable universe and other relevant criteria. This information essentially tells the algorithm what criteria to apply when running the simulation, what constraints to consider and any foreseeable cost.

Capital / Duration

Set the initial capital you want to to invest in the simulation, and the timespan of its backhistory.

Market filtering

Bound your investable universe by providing filters on the Market of reference for the simulation. Several macro (e.g. Country, Market Cap) and micro (e.g. Sector or Industry) attributes can be configured to reflect the universe you have in mind.

Rebalance

Define how frequently you want to rebalance your portfolio in the backhistory. You can also specify a rebalancing day of the week.

Capital / Duration

Set the initial capital you want to to invest in the simulation, and the timespan of its backhistory.

Strategy configuration

Set all relevant parameters that define your systematic investment strategy, such as technical indicators, ranking and distribution strategy of securities in your generated portfolio.

Set fees

Configure the fees and transaction costs, to make the simulation account for these frictions. You can also set a realistic slippage to emulate real-case scenarios where you want to preserve some liquidity.

Benchmark

Select a benchmark to allow comparison among your strategy performance and the benchmark performance across the lifespan of the simulation.

Run strategy backtesting

Once your strategy is set up, you can let Empirico run its backtesting algorithm on it.

In this step, Empirico will generate an initial portfolio out of your universe and then rebalance it according to the criteria you specified.

Unbiased security selection

Systematic selection

Empirico systematically applies the technical indicators to all securities in the universe and selects them using your specified ranking and distribution / weighting criteria.

Powerful algorithm

Empirico runs your strategy on your investable universe, across all securities ever listed in the full lifespan of your simulation history. Its cloud-based algorithm enables data-intensive cloud computation that would otherwise be impossible.

Rebalance

Empirico rebalances your portfolio at intervals you define by applying your strategy to the investable universe, alongside any fees, slippage or specific parameters you defined.

Real scenario simulation

When Empirico rebalances your portfolio in the past, it applies the same operations that you would do in live scenarios. This includes accounting for fees and slippage effects. This way, the simulation perfectly resembles the actualization of a potential past investment.

Listings & Delistings

Listed securities change over time, and a good backtester should account for this. Empirico’s high-quality data provide a comprehensive knowledge about listed and delisted securities, making sure that your portfolio is always consistent with these events.

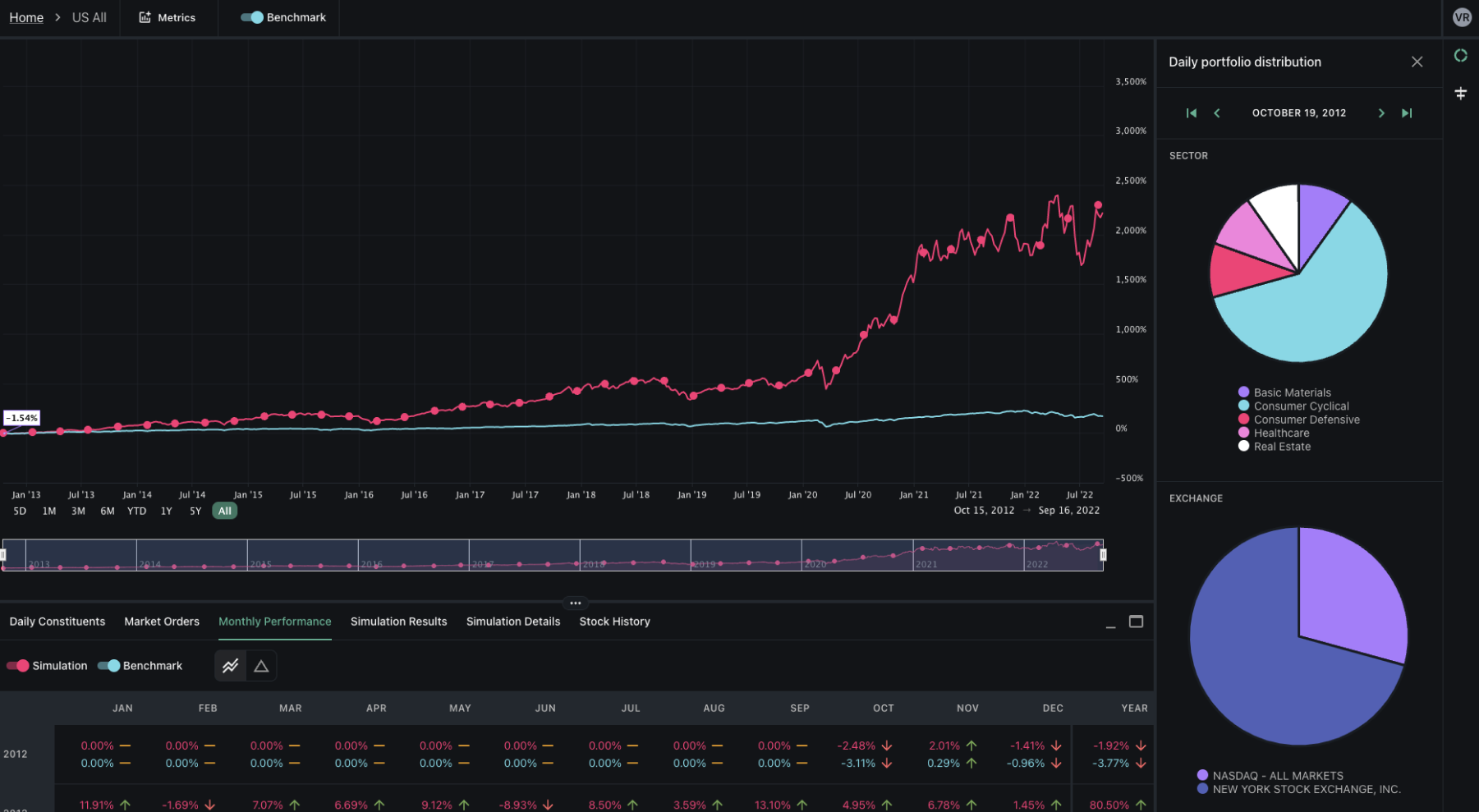

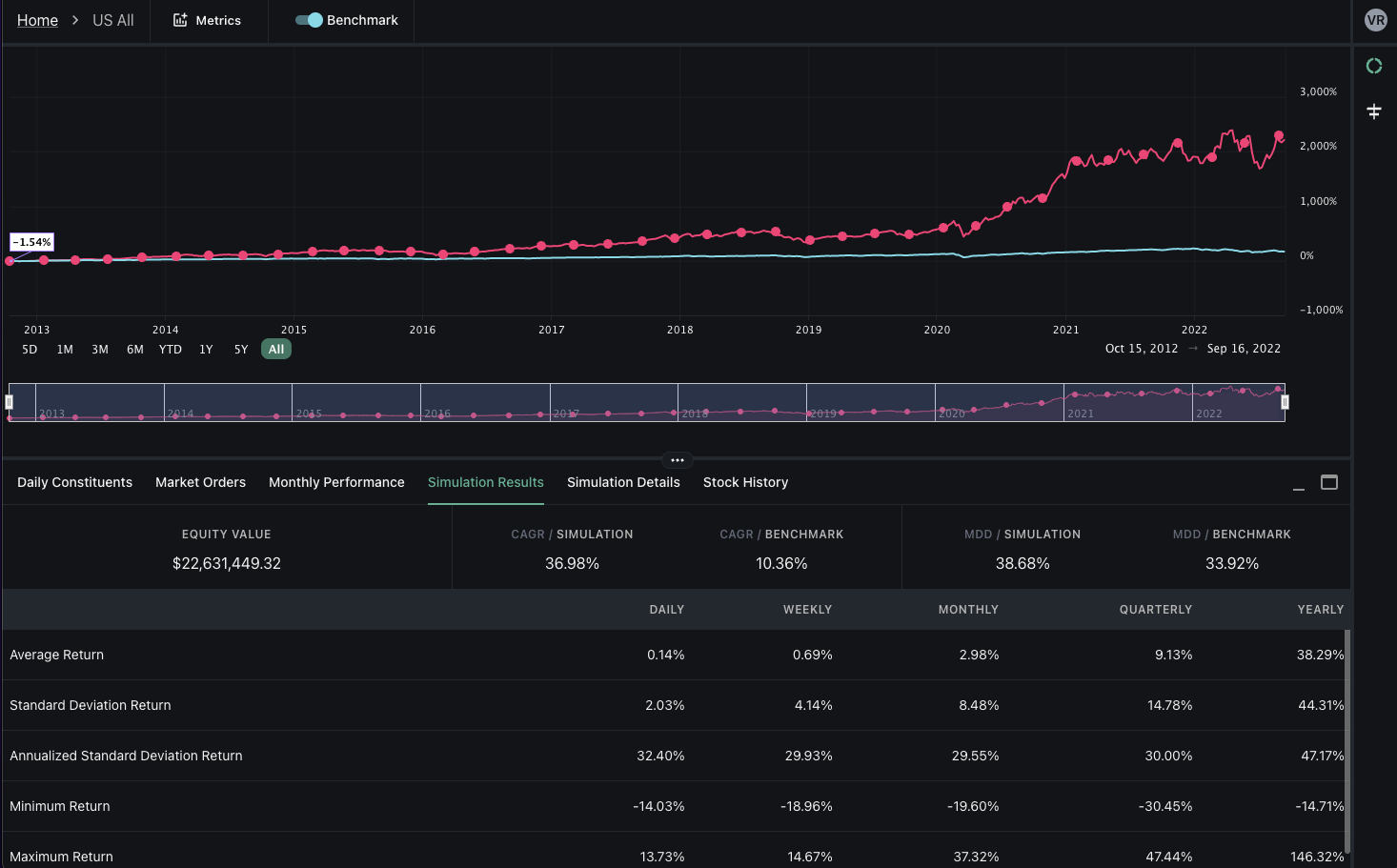

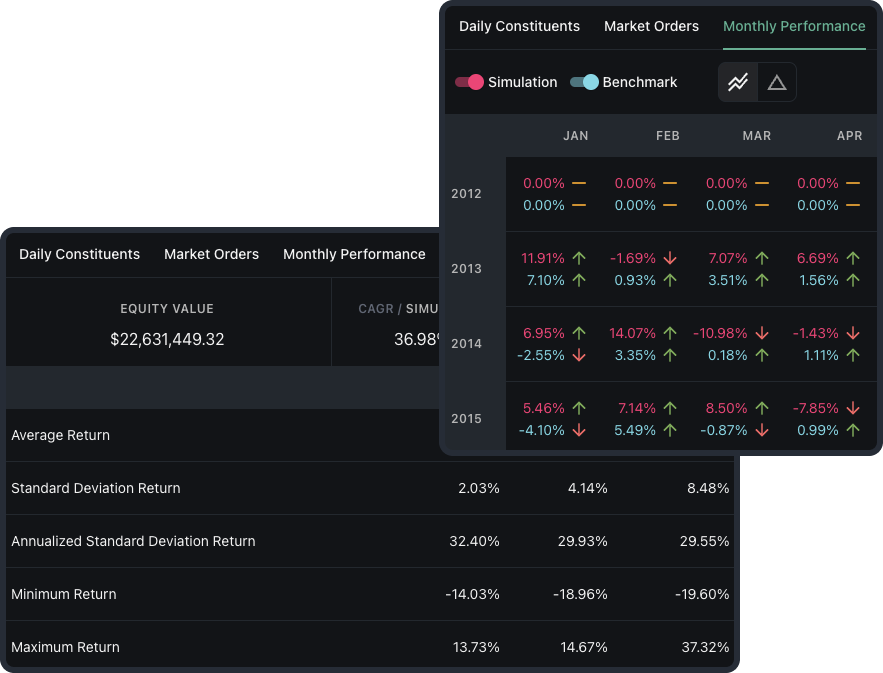

Analyze advanced reporting

For each simulation you run, Empirico provides you with professional level reporting over its outcome.

You are able to grasp into the little details of what happened over time, compare results with a selected benchmark, and even look at securities one-by-one.

Set metrics

Performance over time, Drawdown and Runup Charts, Volatility and more. You can easily activate and get immediate metrics to grasp insights over the simulation outcome.

Market orders

You can easily check all the market orders generated to rebalance your portfolio at each rebalancing day, and access the generated turnover alongside other aggregated indicators.

Portfolio composition

You can easily get an overview of pie charts with portfolio composition distribution across several securities attributes.

Monthly and yearly performance

Overview of monthly and yearly performance generated by the simulation, including benchmark comparison or benchmark performance difference.

Daily constituents and stock history

Empirico lets you explore your portfolio construction day-by-day in the lifespan of the backtest. You can easily focus on rebalancing days or on specific time intervals. Furthermore, you can check all transactions for every single security that entered your portfolio.

Simulation results

Empirico provides several aggregated indicators to analyze the goodness of the simulation, such as CAGR, MDD, average returns, max-min returns, Sharpe Ratio, longest positive and negative stripes. They can all be assessed daily to yearly and compared with the selected benchmark.

Compare strategies

Advanced strategies comparison

We are working to make strategy comparison even more powerful, by adding advanced reporting comparing every relevant strategy parameters in a single view. Sign up below for relevant updates on this and other features!

Optimize your strategy

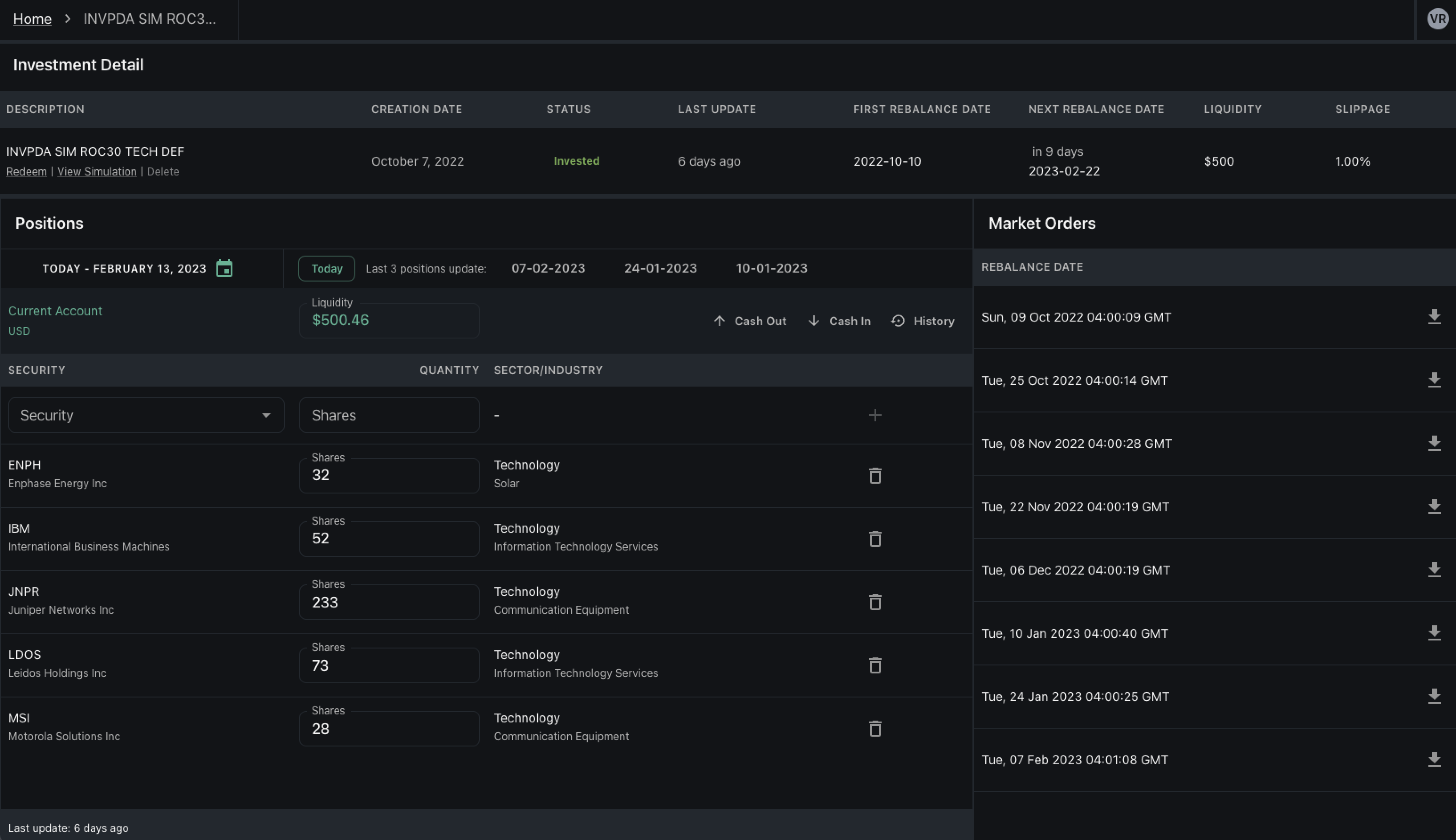

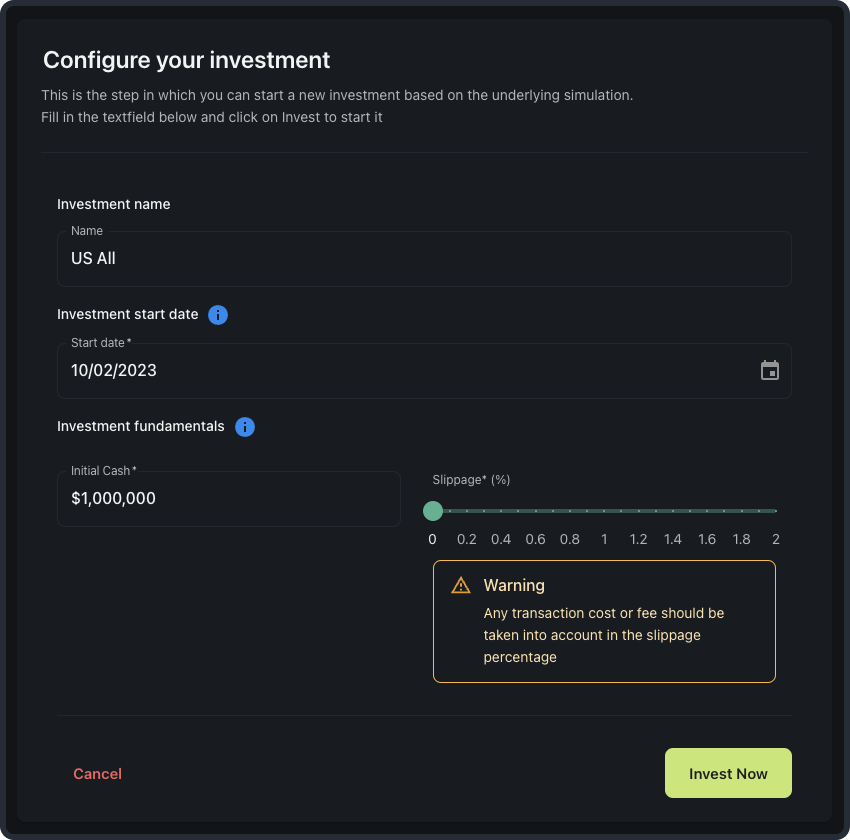

Invest live

Once you have refined your strategy, Empirico can help you use it for active investment. When you activate this feature, an Investment View is generated from your strategy. You will get access to your first portfolio and order list, and you will be able to adjust the list to the actual trades you make.

This way, at any given rebalancing period, Empirico will generate, display and even send you via email the Market Order list to impement according to your defined strategy.

Please note that Empirico is not a trading or brokerage system, and you will have to pass real orders on your third-party platform of choice. The Empirico team is currently working on some direct integrations with the most known trading and brokerage platforms.

Activate Investment View

Given a simulated strategy, you can make it "live" and generate an Investment Views that applies the strategy in real-time.

Adjust your portfolio

You can correct the trades in your investment view anytime before rebalancing, so tha Empirico knows the current situation of your portfolio.

Get a strategy-based market order list

At each rebalancing period, Empirico will generate a Market Order list to apply to your portfolio to apply your strategy over time.

Do you want a preview of Empirico?

Empirico is open to integrate any reliable market data provider who wants their user to leverage the power of backtesting.